Cash is vital to a company in order to finance operations, invest in the business, pay expenses, etc. Since cash can’t be manipulated like earnings can, it’s a preferred metric for analysts. If a company’s net margin is 15%, for example, that means its net income (or profit) is 15 cents for every $1 of sales the company makes.

A ratio of 1 means a company’s assets are equal to its liabilities. Less than 1 means its liabilities exceed its short-term assets (cash, inventory, receivables, etc.). A ratio of 2 means its assets are twice that of its liabilities. A ‘good’ number would usually fall within the range of 1.5 to 3.

Grupo Financiero Santander Mexico SAB De CV Series B ADR Company Profile

If the volume is too light, in absolute terms or for a relatively large position, it could be difficult to execute a trade. This is also useful to know when comparing a stock’s daily volume (which can be how to download metatrader 4 on mac found on a ticker’s hover-quote) to that of its average volume. A rising stock on above average volume is typically a bullish sign whereas a declining stock on above average volume is typically bearish.

- Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser.

- Western New England Bancorp (WNEB) was a big mover last session on higher-than-average trading volume.

- So be sure to compare it to its group when comparing stocks in different industries.

- Investors like this metric as it shows how a company finances its operations, i.e., what percentage is financed thru shareholder equity or debt.

- In the same quarter last year, Banco Santander’s earnings per share (EPS) was $0.25.

Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered.

Is It Time to Buy BSM? Shares are down today.

JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. None of these entities provide legal, tax, or accounting advice. This time period essentially shows you how the consensus estimate has changed from the time of their last earnings report. Ideally, an investor would like to see a positive EPS change percentage in all periods, i.e., 1 week, 4 weeks, and 12 weeks. The 1 Week Price Change displays the percentage price change over the last 5 trading days using the most recently completed close to the close from 5 days before. A company with an ROE of 10%, for example, means it created 10 cents of assets for every $1 of shareholder equity in a given year.

- Provides a range of financial services to individuals, private banking clients, small and medium-sized enterprises, government institutions, and corporate and institutional customers primarily in Mexico.

- The company operates through Retail Banking and Corporate and Investment Banking segments.

- The 4 Week Price Change displays the percentage price change for the most recently completed 4 weeks (20 trading days).

- It serves individuals, private banking clients, small and medium-sized enterprises, middle-market corporations, government institutions, and corporate and institutional customers.

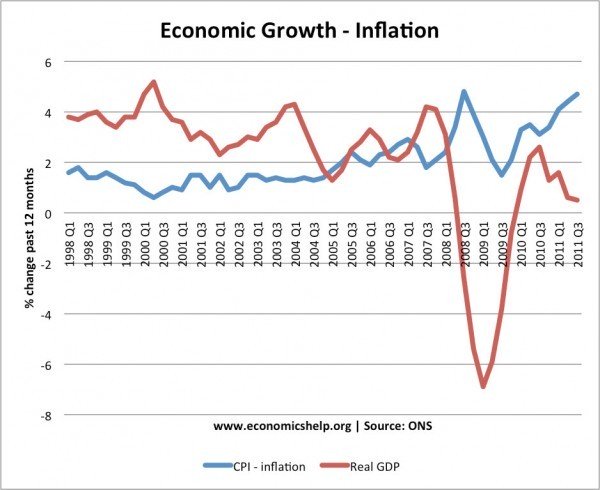

Federal Reserve Governor Christopher Waller told CNBC on Tuesday that the Fed can “proceed carefully” with further interest rate hikes. “There is nothing saying we need to do anything imminent,” he said of additional increases, basing his view on recent economic data. Oil prices spiked about 1% to a 10-month high after Saudi Arabia and Russia said they would continue with their oil production cuts into the end of the year. Shareholders voted to give the special-purpose acquisition company trying to take the former president’s media firm public another year to complete the merger. Digital World Acquisition Corp. previously faced a deadline of Friday to finish the deal.

About MarketBeat

Enterprise Value (EV) is Market Capitalization + Debt – Cash. Many investors prefer EV to just Market Cap as a better way to determine the value of a company. EBITDA, as the acronym depicts, is earnings before interest, taxes, depreciation and amortization. That means these items are added back into the net income to produce this earnings number. Since there is a fair amount of discretion in what’s included and not included in the ‘ITDA’ portion of this calculation, it is considered a non-GAAP metric. The EV/EBITDA ratio is a valuation multiple and is often used in addition, or as an alternative, to the P/E ratio.

And like the P/E ratio, a lower number is typically considered ‘better’ than a higher number. The Momentum Scorecard focuses on price and earnings momentum and indicates when the timing is right to enter a stock. Provides a range of financial services to individuals, private banking clients, small and medium-sized enterprises, government institutions, and corporate and institutional customers primarily in Mexico. The company was founded in 1991 and is based in Mexico City, Mexico.

Company Summary

That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B. The Value Scorecard identifies the stocks most likely to outperform based on its valuation metrics. This list of both classic and unconventional valuation items helps separate which stocks are overvalued, rightly lowly valued, and temporarily undervalued which are poised to move higher. No content on the Webull Financial LLC website shall be considered as a recommendation or solicitation for the purchase or sale of securities, options, or other investment products.

Banco Santander México: A Strong-Buy Recommendation for … – Best Stocks

Banco Santander México: A Strong-Buy Recommendation for ….

Posted: Tue, 04 Jul 2023 07:00:00 GMT [source]

For more information on risks and conflicts of interest, see these disclosures. No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. Note; companies will typically sell for more than their book value in much the same way that a company will sell at a multiple of its earnings. While a P/B of less than 3 would mean it’s trading at a discount to the market, different industries have different median P/B values.

Investors like this metric as it shows how a company finances its operations, i.e., what percentage is financed thru shareholder equity or debt. A ratio under 40% is generally considered to be good.But note; this ratio can vary widely from industry to industry. So be sure to compare it to its group when comparing stocks in different industries. A stock with a P/E ratio of 20, for example, is said to be trading at 20 times its annual earnings. In general, a lower number or multiple is usually considered better that a higher one.

It’s another great way to determine whether a company is undervalued or overvalued with the denominator being cash flow. Like the earnings yield, which shows the anticipated yield (or return) on a stock based on the earnings and the price paid, the cash yield does the same, but with cash being the numerator instead of earnings. For example, a cash/price ratio, or cash yield, of .08 suggests an 8% return or 8 cents for every $1 of investment. The Cash/Price ratio is calculated as cash and marketable securities per share divided by the stock price.

Value investors will typically look for stocks with P/E ratios under 20, while growth investors and momentum investors are often willing to pay much more. Aside from using absolute numbers, however, you can https://investmentsanalysis.info/ also find value by comparing the P/E ratio to its relevant industry and its peers. The 52 Week Price Change displays the percentage price change over the most recently completed 52 weeks (260 trading days).

(Delayed Data from NYSE)

According to the CME FedWatch Tool, futures are currently pricing in no more interest rate hikes for this cycle and a potential interest rate cut by May 2024. Banco Santander (BSMX) reported Q earnings per share (EPS) of $0.33, beating estimates of $0.26 by 29.69%. In the same quarter last year, Banco Santander’s earnings per share (EPS) was $0.25.

As a point of reference, over the last 10 years, the median sales growth for the stocks in the S&P 500 was 14%. Of course, different industries will have different growth rates that are considered good. So be sure to compare a stock to its industry’s growth rate when sizing up stocks from different groups.

As an investor, you want to buy stocks with the highest probability of success. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. The 20 Day Average Volume is the average daily trading volume over the last 20 trading days.

Please read the Characteristics and Risks of Standardized Options before trading options. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods.